Growth vs. Value Investing — and Why Pilots Should Understand Both (Plus What Lives Off Wall Street)

One of the first questions pilots ask when they start investing outside the cockpit is deceptively simple:

“Should I focus on growth or value?”

Like most things in aviation and investing, the real answer is: it depends on your mission, your risk tolerance, and your time horizon.

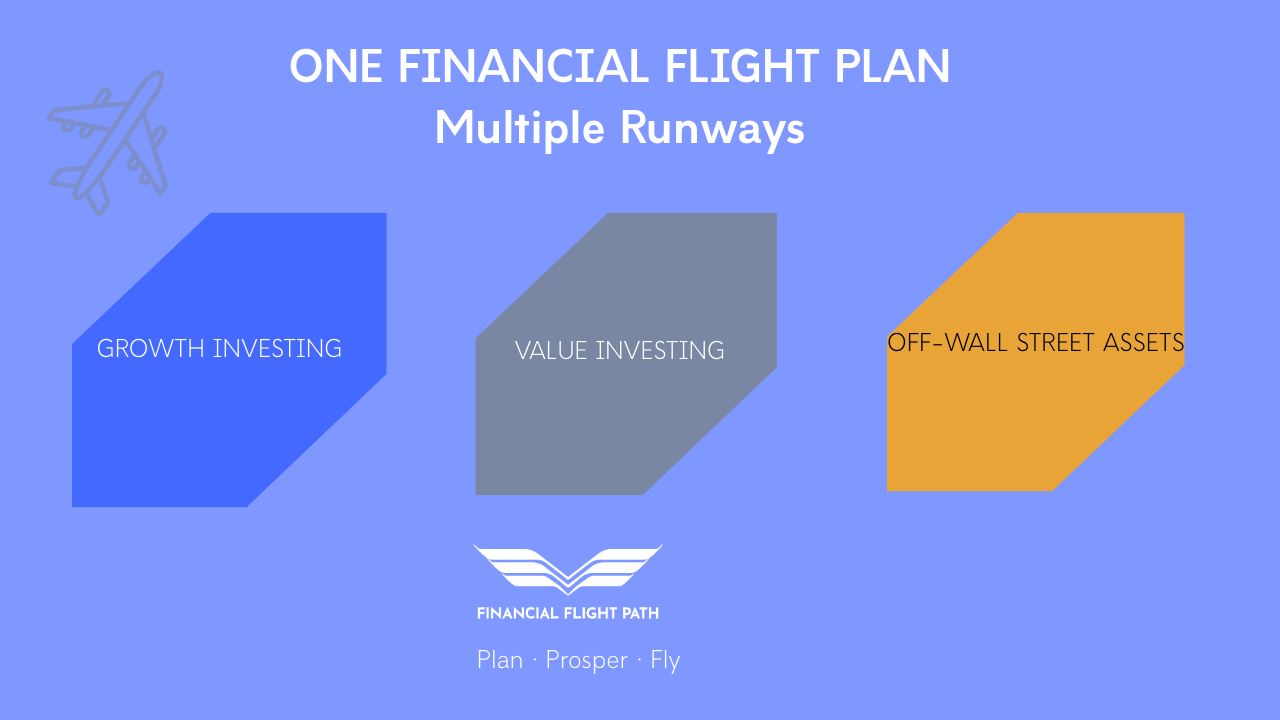

Growth and value investing are two classic approaches used in the stock market, and understanding the difference helps you make smarter decisions—not just with stocks, but with every investment you evaluate, including real estate and off-Wall Street opportunities.

Let’s break it down in plain English.

Growth Investing: Betting on What Could Be

Growth investing is about companies that are expected to grow faster than the overall market. These are businesses reinvesting profits to expand operations, develop new products, or capture market share rather than paying dividends.

Think of growth investing as flying toward where demand is going, not where it’s been.

Characteristics of Growth Investments

-

P

...

Your Pre-Flight Financial Checklist: Don't Let 2026 Take Off Without It

Your financial life deserves the same level of discipline and attention to detail.

With just days left in 2025, now is the time to complete your year-end financial pre-flight. The December 31st deadline isn't just a date on the calendar—it's your last chance to make strategic moves that will set you up for a stronger 2026.

Why This Matters More for Pilots

I've spent over 30 years in the cockpit, and I learned the hard way that our industry can change overnight. After 9/11, I was forced to choose between a leave of absence or furlough. There were no flying jobs. No backup plan. No financial runway.

That experience taught me something every pilot needs to understand: You cannot afford to "wing it" with your money.

Too many pilots are flying through their fina

...Earners vs. Owners: Why Pilots Must Shift Their Financial Flight Path Before the Next Storm Hits

Every pilot knows what it feels like to hit unexpected turbulence.

One minute you’re cruising at altitude, everything trimmed out and smooth…

and in the next minute you’re dealing with sudden chop that tests your focus, discipline, and training.

Financial turbulence works the same way — especially in aviation.

If you’ve been in this industry long enough, you know it’s not if a storm hits… it’s when.

For many of us, those storms leave deep scars.

I know they did for me.

After 9/11, I lost everything.

No backup plan.

No income diversification.

Three small kids at home.

A mortgage.

A career I loved suddenly gone.

I promised myself I would never again rely on one source of income — no matter how strong, stable, or prestigious it appeared.

That promise became the foundation of Financial Flight Path.

And this week, something hit me hard enough that I knew I needed to share it with you.

*Taxing the Rich doesn't work - and why it matters to us pilots!*

Some of you already know...

✈️ Final Approach: 6 Smart Tax Moves Pilots Should Make Before April 15th

Tax season hits like a surprise holding pattern—and if you’re like most pilots, it probably wasn’t at the top of your to-do list. Between bidding schedules, simulator sessions, and layovers, it’s easy to push paperwork aside.

But with the April 15th deadline on final approach, there’s still time to take a few critical steps that could save you money, reduce stress, and even set you up better for next year.

Here are six things you can do today to get your taxes on glidepath:

1. Gather All Income Sources

Pilots often wear more than one hat—flying trips, instructing on the side, renting out property, or investing.

✅ Action Item: Make sure you’ve collected all your income documents:

-

W-2 from your airline

-

1099s from side hustles (e.g. flight instruction, Airbnb)

-

Investment income (1099-INT, 1099-DIV, etc.)

-

Rental property income and expenses

Don’t forget per diem reimbursements—these can be deductible depending on your employment structure and how much was pa...

Take Control of your Financial Future

April is Financial Literacy Month – Time to Take Control of Your Financial Future!

As a commercial airline pilot, you've trained for years to master the skies, but how much time have you spent mastering your finances? Whether you're a high earner at a legacy airline or a new FO working toward captain pay, your financial future depends on what you do now.

April is Financial Literacy Month, and there’s no better time to take control. You’ve already worked hard to land a career that provides a great income—now let’s make sure you’re putting it to work for you.

Why Financial Literacy Matters for Pilots

Aviation is a high-income career, but it’s also full of financial risks:

✈️ Medical disqualification risks – If you lose your medical, will you still have income?

✈️ Industry volatility – Airline bankruptcies, furloughs, and downturns happen.

✈️ Spending creep – As paychecks grow, so do expenses—unless you take control.

Most pilots don’t lack money. They lack a plan to make it work for ...

Execution is Everything

Pilots are natural problem solvers. We train, prepare, and execute under pressure because hesitation in our world isn’t an option. Yet when it comes to creating financial security beyond the cockpit, many of us stall out before we ever take off.

Seth Godin puts it plainly: “There’s no shortage of remarkable ideas, what’s missing is the will to execute them.”

Ideas Are Cheap—Execution Is Everything

If you’ve spent any time in the Financial Flight Path community, you’ve likely thought about diversifying your income. Maybe it’s real estate investing, starting an online business, or diving into the stock market. The idea itself isn’t the problem—the challenge is taking the first step.

Think about it. How many times have you heard a fellow pilot say:

- "I should really start investing, but I don’t know where to begin."

- "I’ve always wanted to buy a rental property, but the market feels risky."

- "I’ve got this great business idea, but I just don’t have the time."

Sound familiar? If s...

Navigating Financial Skies with Budgeting

As commercial airline pilots, managing personal finances effectively is essential amidst the dynamic nature of our careers.

To navigate the financial skies with confidence, it's crucial to employ the right budgeting strategies. Here are five tailored budgeting approaches to help pilots take control of their finances and soar towards their financial goals.

- Traditional Budgeting:

- Track income and expenses meticulously, either manually or using user-friendly budgeting apps.

- Categorize expenses to gain insights into spending patterns, such as housing, travel, and aviation-related costs.

- Identify areas for optimization to ensure financial stability amidst fluctuating income and expenses.

- 50/30/20 Rule:

- Allocate 50% of income to essential needs like housing, utilities, and aviation-related expenses.

- Dedicate 30% to discretionary spending, including travel adventures, hobbies, and relaxation.

- Commit 20% to savings and investments, ensuring a solid financial foundation f ...

Build a Stable Future: Diversify Your Income as a Commercial Airline Pilot

We all like to take control!

That’s the feeling we get when we take hold of the yoke, or side stick, whether it’s a small single-engine plane, or a transport category aircraft and guiding it skyward, or manipulating the controls for a greased landing!

While we are in control of our flight path, many of us haven’t had the education or the checklist to take control of our financial flight path.

Even on a good day our income depends on so many factors out of our control: the weather; mechanical issues, ground stops, union negotiations, company policies and FARs (that’s Federal Aviation Regulations, for the non-aviation geeks reading!)

Then there is the once, or twice a year medical exam and scores of periodic training sessions, computer-based training and practice in the full-flight simulator.

Few other professions face our unique situation that often spans multiple time zones.

Few other professions face periodic layoffs and displacements – which either eliminate or decimate your ...

Planning for Airline Pilots: Where to Start

As a pilot, you have a unique set of financial planning considerations.

From managing the costs of flight training to saving for retirement, it's important to have a clear plan in place to ensure a secure financial future. Let's explore some of the key elements of financial planning for airline pilots.

Budgeting and Expense Management

The first step in financial planning is creating a budget and managing expenses. This means tracking your income and expenses to ensure that you are saving enough to meet your short- and long-term goals. Consider setting up a budgeting tool or working with a financial planner to help you stay on track.

Risk Management

As a pilot, you face unique risks, such as the possibility of disability or loss of life. To protect your finances in the event of an unexpected event, it's important to have adequate insurance coverage, including disability, life, and health insurance. Review your policies regularly to make sure they are still adequate and afford

...