Who are you hanging out with?

"You're the same today as you will be in five years except for two things: The people you meet and the books you read!"

- Author Sharon Lechter

"Three Feet From Gold: Turn Your Obstacles into Opportunities"

Motivational speaker Jim Rohn was quoted as saying that you are the average of the five people we spend the most time with.

The average of what depends on what you consider important - family, finances, health, relationships, spirituality.

Where ever you are in any of these areas, there is always an opportunity to expand or improve, depending on your priorities.

Change comes by changing your habits or your environment.

Connections matter - both personal and introspective.

If you want to "be rich" in any of those areas, don't complain you're not where you want to be.

Instead, hang out with people who you admire, people who are where you want to be.

If you want to have better relationships, hang out with people who have inspiring relationships.

If you want better f...

What business or investment to start?

Hundreds of pilots are facing a more certain future than they were last March, but so many have lost pay and even entire jobs.

Taking control of your own finances and adding income outside the cockpit is really the only way to secure your own financial future, to secure your own Success Flight Path.

If you aren't really sure what type of business or investment to start, start with what sparks you! What interests you? What types of skills you have that lend themselves to profitability?

Can you teach something? Sell something? Offer guidance in a particular area?

Below are just a few questions to ask yourself when starting your search:

What do you like to do?

- What you are good at doing? (If you're not sure, ask friends, family and co-workers.)

- What do people ask you for help doing?

- What you can do that others that they can’t or don’t want to do?

- What people are willing to pay for you to do?

- How much would other people pay you to do that, and would that amount be ...

Advent Calendar - Happy Holidays

When you plan, there is peace. You have direction. You can accommodate the unexpected and you can allow for the "good" surprises.

This holiday season, enjoy the Success Flight Path Advent Calendar.

Enjoy the motivation and direction to set you up for the New Year, whether you're flying, furloughed, displaced, or still waiting to see what the airlines have in mind for you.

Happy Holidays.

Think Big - Start NOW

As pilots we start off with a basic Private Pilot's license.

And just like Karate, there are stages to a pilot's success.

Instrument Rating; Commercial Rating; Multi-Engine Rating; all of the instructor ratings, and finally the coveted Airline Transport Rating - the big one, the one that allows you to make a real career out of flying and possibly the big bucks.

For every takeoff, there is a landing. For each prosperous run for the airlines, there is a downswing and that downswing is never in the pilot's control.

The difference between thriving in the downturns is having a backup plan, a checklist you can rely on.

After 9/11, I had less than three weeks to figure out where my next paycheck was going to come from.

So, I started small, secured a freelance writing contract and signed up for real estate school.

Those small steps are still paying big dividends today.

“The best time to plant a tree was 20 years ago. The second best time is now.” – Chinese Prover...

Can't plan a trip - might as well get a head start on Next Year's goals

While on a Vegas layover I stopped for a selfie with the Eiffel Tower. It's a tradition I've had, sending the pictures to someone who I taunt every year about taking me to the top of the real Eiffel Tower for my birthday. (I hear the views are great, but the restaurant is overrated.)

Needless to say, I am not making any plans for a pleasure trip any time soon. With all of this time on my hands and traveling options limited, now is a great time to plan your time for outside the cockpit for next year.

We don't know what's going to happen - if airlines are going to continue to furlough, or displace pilots, or if more airlines are going to go out of business.

Before more stress hits the industry, now would be a great time to get your ducks in order with a side-hustle income or investment.

The Success Flight Path is launching early next month.

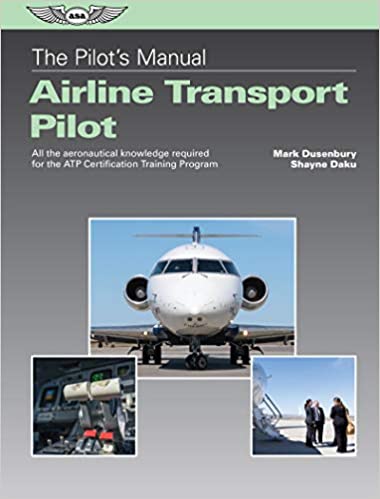

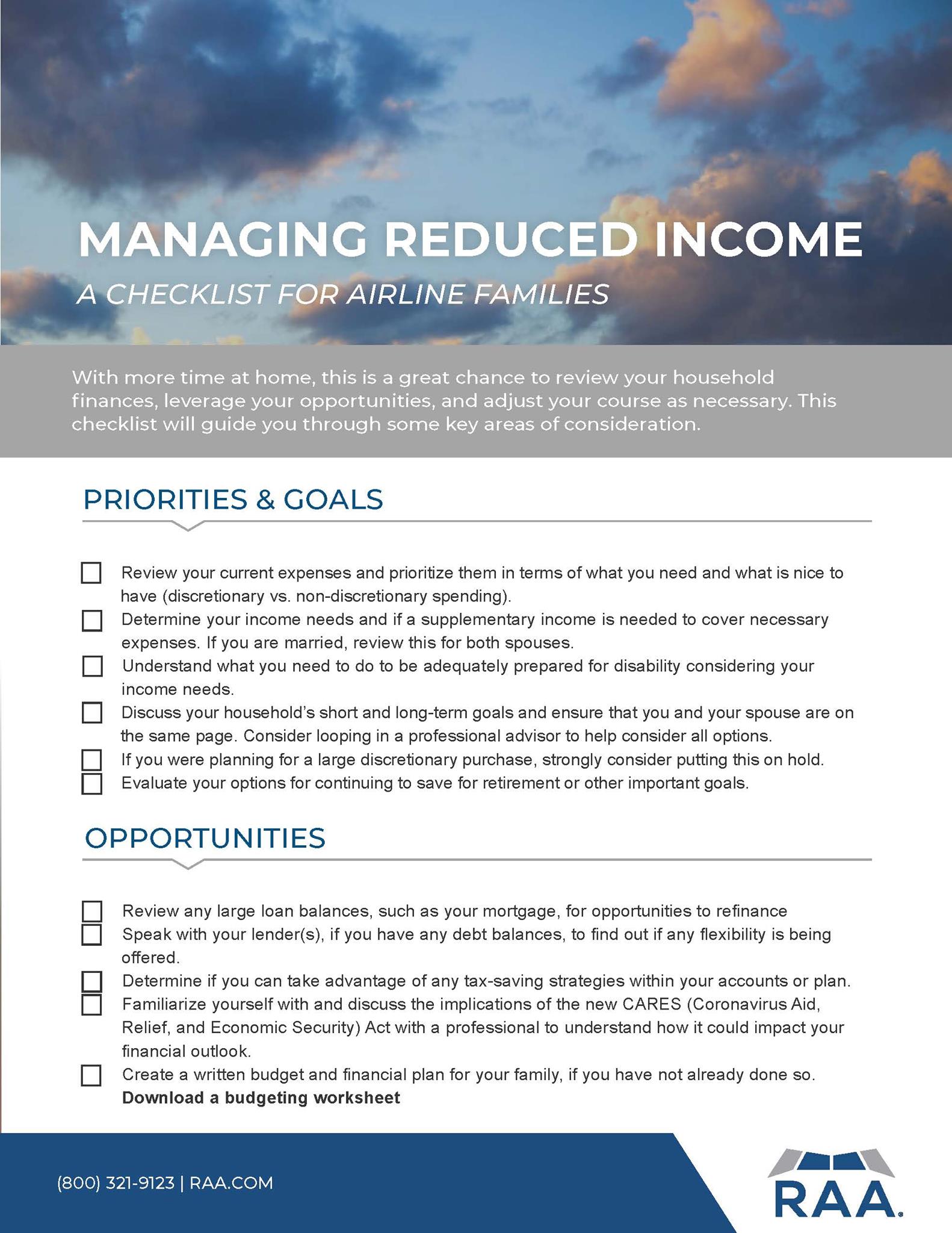

Managing Reduced Income Checklist

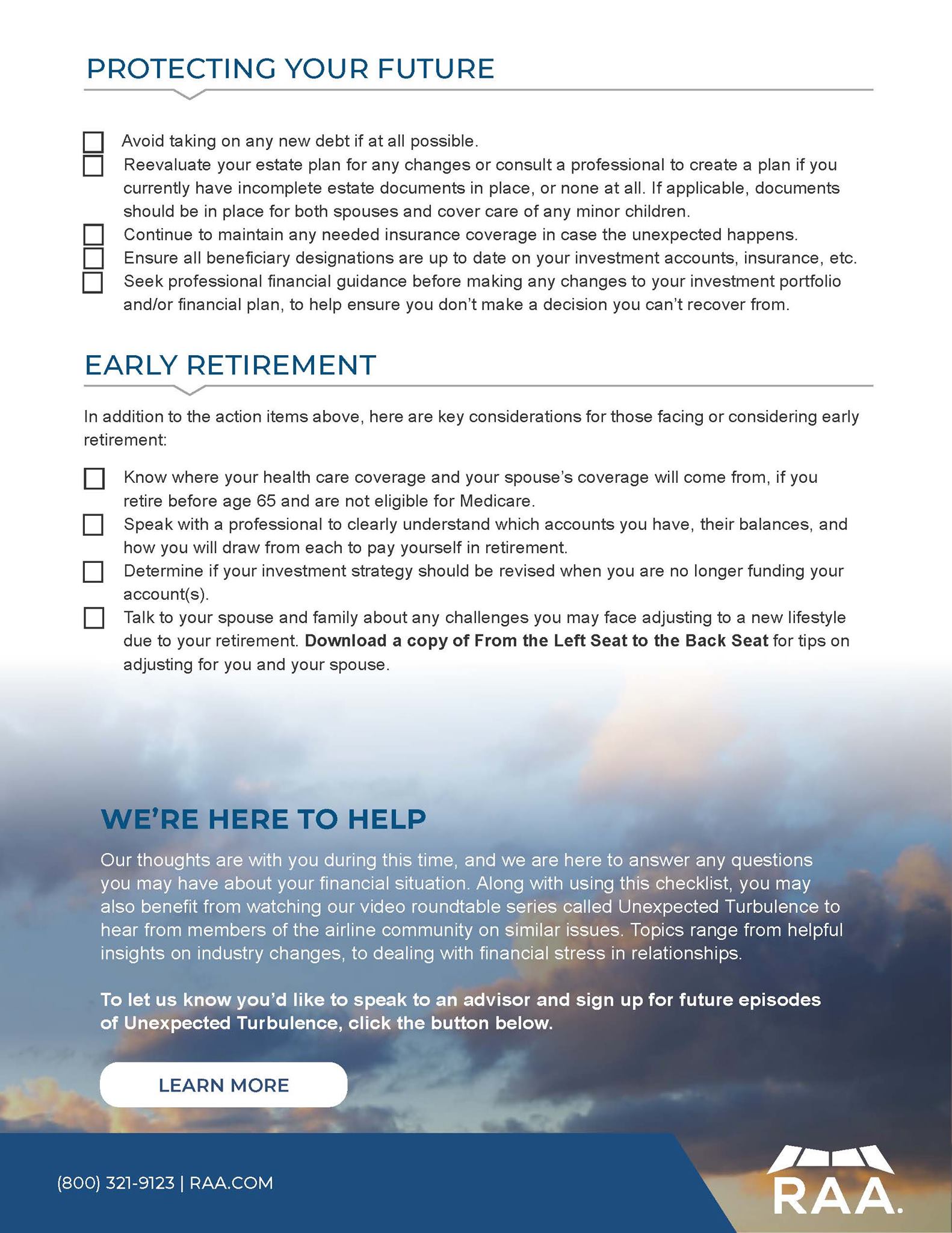

After a lot of research, I tripped over a great gem of a Checklist from RAA.com, a financial consulting firm that caters to professional pilots.

Check it out: "Managing Reduced Income: A Checklist for Airline Pilots

Semi-Passive Income

Today we hear from a Guest Writer, Tim Glasser with Franchise Copilots!

Nearly every pilot I’ve talked to is interested in ways to invest some of their money that will result in predictable additional income with a good rate of return. Obviously you can invest in mutual funds and perhaps get an 8% return over time. This is almost entirely a passive investment, as it consumes very little of your time.

But what if you expect to get significantly more than 8%? If you are willing to spend some of your time and energy to manage your investment, but want to keep the aviation career you love, then a semi-passive franchise business opportunity might be right for you.

Semi-passive franchise businesses are found in a range of industries, but they tend to have some common characteristics:

● The business model has already been proven to be successful if you follow the playbook

● The operational systems and supporting technology are provided by the franchisor

● They are driven by m...

Three Passive Income Streams for pilots

Unlike the W-2 incomes earned from working at an airline, passive income has several tax advantages.

First and foremost, passive incomes are not subject to Social Security and Medicare taxes.

Passive incomes are rents, royalties, dividends, interest, and short-term and long-term capital gains.

According to Anderson Advisors:

" Passive income is not subject to withholding or Social Security and Medicare taxes. This automatically eliminates the combined 15.3% Social Security and Medicare taxes and amounts to an additional 14 cents of every dollar back in your pocket when the same income is earned passively instead of actively."

Passive income is not subject to withholding or Social Security and Medicare taxes. This automatically eliminates the combined 15.3% Social Security and Medicare taxes and amounts to an additional 14 cents of every dollar back in your pocket when the same income is earned passively instead of actively."

Think about that - keeping 14 percent more of your hard-earned income!

Three smart moves for passive income are:

- Dividends

- Options

- Real Estate

While once wildly popular with investors, there are still some companies that pay dividends to their shareholders. While taxed, these dividends are taxed at a lower rate than many active income rates.

Option...

Life after the cockpit

After more than 25 years in the cockpit, Captain Vince Kramer recently hung his wings up. Like so many airline pilots these days, he took an early retirement package from a major airline.

Here he offers some insight into how he found a passion and is pursuing it and hopes to inspire pilots facing furloughs and displacements to find their passions as well.